This is the second in a series of four blog posts on MediaVerse, the Blockchain and Cryptocurrencies all of which you can find in the Blockchain section.

After the previous blog post on the Blockchain fundamentals, this one is about Crypto‑assets, which allow revenues management and the representation of “shareable” rights (e.g., the ownership of an asset) and “non-sharable” rights (e.g., the right to reproduce a song) on the Blockchain (advanced readers may find further detailed information in “D4.1 – Copyright and Procedures for IPR Definition”).

Crypto-assets

According to Don Tapscott and Alan Majer [1]Majer, A. (2019). Non-Fungible Tokens: Transforming the Worlds of Assets, Gaming, and Collectibles. Blockchain Research Institute, crypto-assets can be split into eight categories. Table 1 shows this categorisation.

| Cryptocurrencies | Support payments via blockchains (e.g., Bitcoin, Monero, Zcash). |

| Protocol tokens | Support the distributed applications running on the blockchain (e.g., Ether, NEO, ICON). |

| Utility tokens | Native DApps tokenstied to functionalities provided by a DApp (e.g., Golem token). |

| Security tokens | Digital versions of securities (stocks or bonds) that usually represent an investment contract where the purchaser expects future profits from the investment. |

| Natural asset tokens | Digital assets representing tangible world assets (e.g., oil barrels, grain) managed and traded digitally. |

| Stablecoins | Low-volatile crypto-assets pegged to fiat currencies (e.g., US dollars, Euros) or to a basket of specific assets (e.g., International Monetary Fund’s special drawing right)[2]Lesavre, L., Varin, P., & Yaga, D. (2021). Blockchain Networks: Token Design and Management Overview. National Institute of Standards and Technology. https://doi.org/10.6028/nist.ir.8301 |

| Crypto fiat currencies (CBDCs) | Crypto-assets created and controlled by governments or central banks representing digital versions of fiat currencies. |

| Non-fungible tokens (NFTs) | Unique digital assets not interchangeable with each other. |

The above classification highlights the need to clearly distinguish between crypto-assets required to “pay” services or goods (i.e., cryptocurrencies, CBDCs, stablecoins) and crypto-assets needed to support the blockchain-based distributed environment (i.e., protocol tokens). Indeed, protocol tokens support the execution of transactions or processing on the blockchain as, for instance, on Ethereum, to pay for mining blocks and Smart Contract executions. They can imply an explicit cost (e.g., on Ethereum or other permissionless blockchains) or an implicit one (e.g., in permissioned blockchains where community members provide the infrastructure and pay for the processing and communication capabilities required by the infrastructure).

Concerning the crypto-assets required to pay for the services or goods deployed on or provided through the blockchain, the natural alternatives are stablecoins or CBDCs, due to the inherent volatility of crypto tokens. Following Beck (2021) stablecoins can be further classified as: )):

| Redeemable or convertible stablecoins | Stablecoins backed by a reserve allowing owners to redeem the tokens with the underlying assets (e.g., USDC, USDT). |

| Synthetic stablecoins | Stablecoins used to track the price of one or more underlying assets that do not guarantee any redemption value. Theymay also be backed by multiple assets distinct from the tracked ones (e.g., sUSD). |

| Algorithmic stablecoins | Stablecoins that adopt an algorithmic approach, adjusting the supply in response to price fluctuations (e.g., AMPL, yUSDC). |

Stablecoins can be subject to regulations by central banks to reduce risks (e.g., redeemability, financial, money laundering, privacy compliance). For example, the US Federal Bank has approved “the use of stablecoins […] for the settlement of financial transactions by banks” (January 2021 Trends Report. EU Blockchain Observatory & Forum. The US OCC issued an interpretive letter (Gould, J. V. (2021, January)) that clarifies how national banks and federal savings associations can use certain stablecoins or cryptocurrencies for regular banking transactions. On the EU side, the ECB (European Central Bank) is wondering whether to regulate the use of stablecoins, recognising that, on the one hand, they help in addressing unmet consumer demand, but, on the other hand, they pose challenges and risks [3]Adachi, M., et al. (2020, October. It is therefore plausible that the ECB will issue specific regulations to assure that “the Eurosystem relies on appropriate regulation, oversight, and supervision to manage the implications of stablecoins (and the risks that stem from them)” (No. 247; Occasional Paper Series (2020, September). European Central Bank).

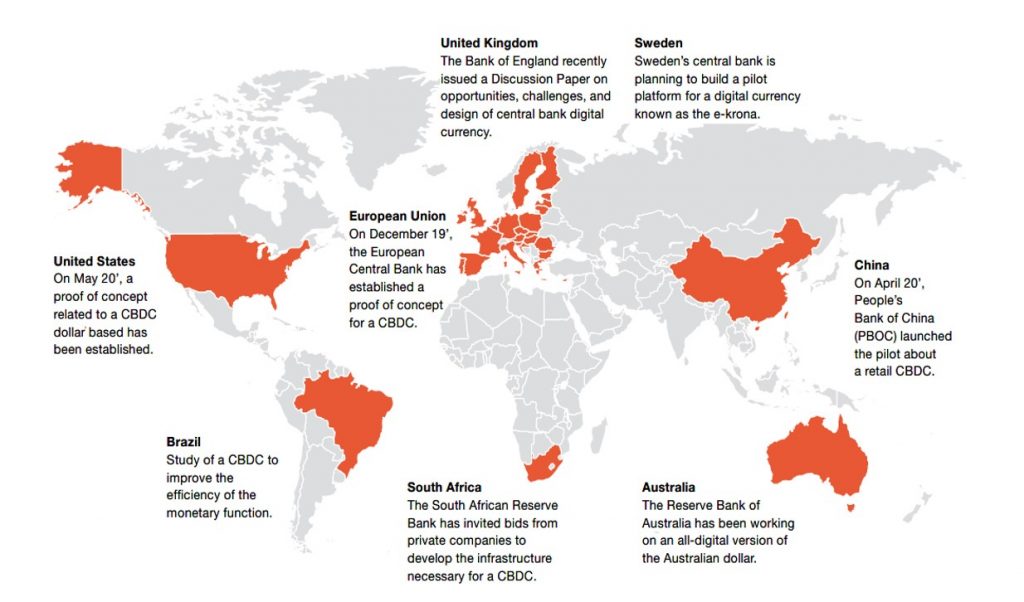

A possible approach to overcome the envisaged stablecoinsand cryptocurrenciesrisks is using “Central Bank Digital Currencies” (CBDCs). Many countries have advanced projects for providing their “digital currency” (Figure 1). According to the recent Bank for International Settlements (BIS) survey, 86% of central banks are actively researching the potential for CBDCs, 60% are already experimenting with the technology, and 14% are deploying pilot projects. CBDCswill be better positioned in terms of trustiness, efficiency, and payment functionality (e.g., wider acceptance, no significant “learning steps” for citizens, interoperability between digital and physical worlds, no exchange costs, and accessibility).

On the EU side, the ECB has advanced plans to launch a digital euro, as documented, for example, in the October 2020 ECB report. Immediately after, ECB launched a public consultation on the outcomes of this report asking citizens, firms and other subjects for opinions. The consultation was closed in January 2021 and the initial indications highlighted an “increased demand for electronic payments in the euro area that would require a European risk-free digital means of payment, a significant decline in the use of cash as a means of payment in the euro area, the launch of global private means of payment”. The related report confirms that “most of the respondents are willing to support Digital Euro, especially given the Eurosystem […] would not use digital euro to either discontinue cash or lower interest rates in the economy”.

Additional objectives of the digital euro are to avoid financial instability and dominance of non-EU financial providers for EU payments which could threaten the stability of the EU financial system. As reported in the Bloomberg interview with ECB President Christine Lagarde, the digital euro is expected to become fully operative in four years. Indeed, on July 14th 2021, the ECB announced the launch of the digital euro and the start of a 24 months investigation phase to identify the technicalities and distribution mechanisms of the digital euro.

References

| ↑1 | Majer, A. (2019). Non-Fungible Tokens: Transforming the Worlds of Assets, Gaming, and Collectibles. Blockchain Research Institute |

|---|---|

| ↑2 | Lesavre, L., Varin, P., & Yaga, D. (2021). Blockchain Networks: Token Design and Management Overview. National Institute of Standards and Technology. https://doi.org/10.6028/nist.ir.8301 |

| ↑3 | Adachi, M., et al. (2020, October |